Group Problem Set 1: This problem Set is based on materials covered in modules 1 and 2.

Group Problem Set

BA 620 Managerial Finance

Group Problem Set 1: This problem Set is based on materials covered in modules 1 and 2. It is designed for you to demonstrate your understanding of basic financial statements, financial statement analysis, break-even concepts, financial and operating leverages. Before you start this assignment, please review Modules 1 and 2 materials

thoroughly.

Finance date of Adams Stores, Inc. for the year ending 2016 and 2017.

Items 2016 2017

Sales $3,432,000 $5,834,400

Cash 9,000 7,282

Other Expenses 340,000 720,000

Retained Earnings 203,768 97,632

Long-term debt 323,432 1,000,000

Cost of goods sold 2,864,000 4,980,000

Depreciation 18,900 116,960

Short-term investments 48,600 20,000

Fixed Assets 491,000 1,202,950

Interest Expenses 62,500 176,000

Shares outstanding (par value =

$46.00) 100,000 100,000

Market Price of stock 8.50 6

Accounts Receivable 351,200 632,160

Accounts payable 145,600 324,000

Inventory 715,200 1,287,360

Notes Payable 200,000 720,000

Accumulated Depreciation 146,200 263,160

Accruals 136,000 284,960

Tax Rate 40% 40%

Instructions:

As a group, complete the following activities using the financial information above:

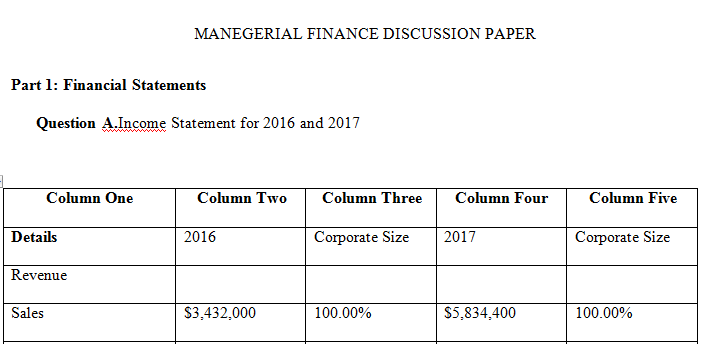

Part 1: Financial Statements

A. Prepare the income statement for 2016 and 2017. Include statement of retained

earnings for 2017. The company paid $11,000 dividend in 2017.

B. Prepare the balance sheet for 2016 and 2017

C. Prepare Common-Size financial statements of income statement and balance

sheet.

D. Prepare Statement of Cash Flows.

Part 2: Financial Statement Analysis

A. Based on your financial statements (from Part 1), calculate the following ratios for

the two years. Show all your calculations in good form. Show your formulas. If

you use excel, each calculation need to show the excel formula

Current ratio

Quick ratio

Inventory turnover (times)

Average collection period (days)

Total asset turnover (times)

Debt ratio

Times interest earned

Gross profit margin

Net profit margin

Return on total assets

Return on equity

P/E ratio

Return on equity using DuPont Analysis

B. Comments on the ratios by comparing 2016 to 2017 ratios.

C. Assume Adams Stores, Inc. is a retail company similar to WalMart, Myers, or

Target. Compare 2017 ratios to the industry average. Please note that Adams

Stores, Inc. is not a real company. To find comparable industry ratios, you need

to search for industry ratios for retail. See information on Moodle for instructions

on how to find industry ratios. Based on the industry average, how is Adams

Stores, Inc. doing financially?

Part 3: Break-even, Financial and Operating Leverages

Johnson Products, Inc.

Income Statement

For the Year Ended December 31, 2018

Sales (40,000 bags at $50 each) ……………………………. $2,000,000

Less: Variable costs (40,000 bags at $25)……………. 1,000,000

Fixed costs…………………………………………………….. 600,000

Earnings before interest and taxes ………………………… 400,000

Interest expense ………………………………………………….. 120,000

Earnings before taxes …………………………………………. 280,000

Income tax expense (20%) …………………………………… 56,000

Net income ………………………………………………………… $ 224,000

Based on the information above, calculate (show all calculations and responses in good

form):

a. Break-even in units (in dollars and units). Explain what your numbers mean. As a

manager, how would you use the numbers in financial planning?

b. What is the degree of financial leverage? Explain what your number mean. As a

manager, how would you use the numbers in financial planning?

c. What is the degree of operating leverage? Explain what your number mean. As a

manager, how would you use the numbers in financial planning?

Specific Instructions:

1. Due: Last day of Module 3.

2. Include only the names of your group members who participated in this

assignment when you submit.

3. Submit only one copy per group.

4. You may use Excel or Word. Please DO NOT use any other format such PDF,

etc.

Side Note: Please note that this is not the type of assignment where the assignment is

divided and each student completes the part that is assigned. Each person in your

group need participate fully in the completion of each part of the assignment.

Answer preview Group Problem Set 1: This problem Set is based on materials covered in modules 1 and 2.

APA

1114 words